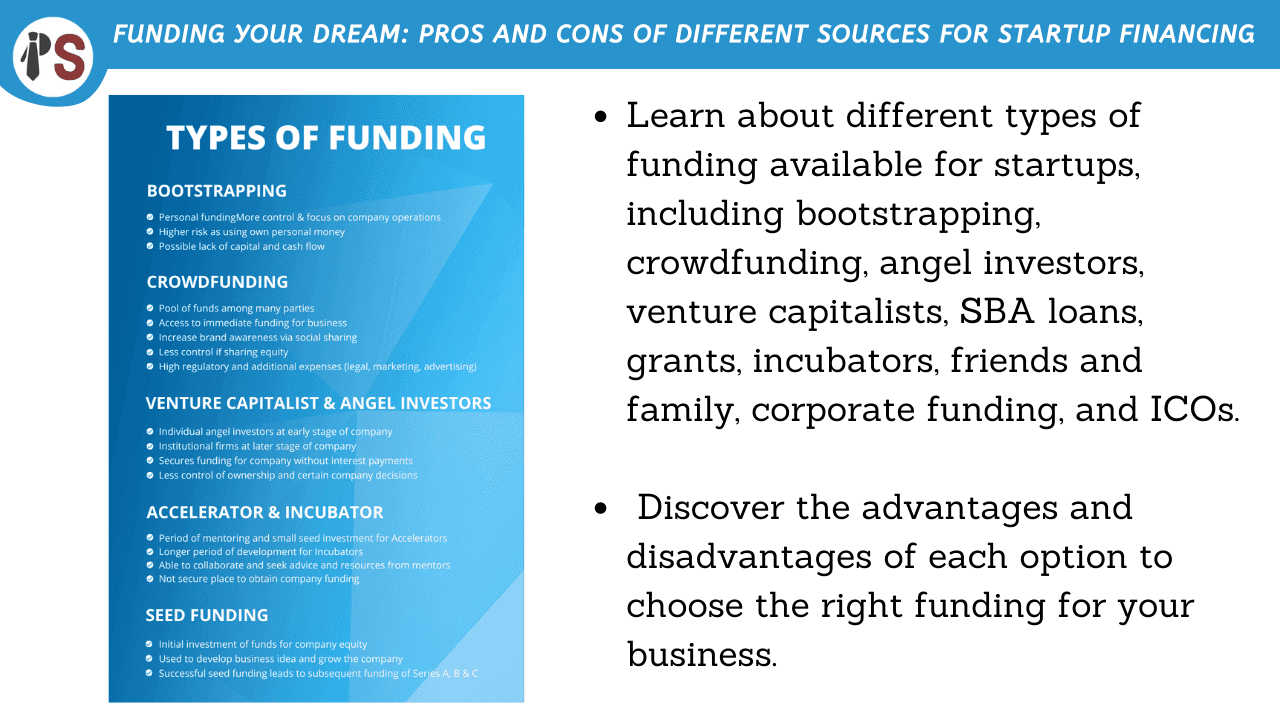

Starting a business can be an exciting but challenging journey. One of the biggest challenges faced by startups and entrepreneurs is securing funding to turn their ideas into reality. Whether it's to fund product development, launch a marketing campaign or expand your business, there are various types of funding available to help you achieve your goals.

In this article, we'll take a closer look at different types of funding, their advantages and disadvantages, and how to choose the right funding option for your business.

Bootstrapping refers to starting and growing a business using personal savings, credit cards, and revenue generated by the business. This funding method is ideal for entrepreneurs who want to maintain complete control over their business and avoid taking on debt or giving away equity. However, bootstrapping can be a slow process, and entrepreneurs may need to make sacrifices in their personal lives to fund their business.

Crowdfunding is a method of raising money by asking a large number of people to contribute small amounts of money through an online platform. This funding option can be a great way to validate your business idea and generate buzz around your product or service. However, it requires a lot of effort and may not be suitable for all businesses.

Angel investors are high net worth individuals who provide funding to startups in exchange for equity. These investors are often experienced entrepreneurs who can provide valuable advice and mentorship to startups. However, angel investors typically invest smaller amounts of money than venture capitalists and may expect a higher return on their investment.

Venture capitalists (VCs) are professional investors who provide funding to startups in exchange for equity. VCs typically invest in startups with high growth potential and are looking for a significant return on their investment. This funding option can provide access to a large amount of capital and valuable industry connections, but VCs may take a large stake in your business and require a significant amount of control.

The Small Business Administration (SBA) provides loans to small businesses that are unable to secure financing through traditional lending channels. SBA loans offer flexible repayment terms and low-interest rates, but the application process can be lengthy and requires extensive documentation.

Grants are funds provided by government agencies, non-profits, and private organizations to support specific projects or initiatives. Grants do not need to be repaid, but they can be highly competitive, and the application process can be time-consuming.

Incubators and accelerators provide startups with access to funding, mentorship, and resources to help them grow their business. Incubators typically offer office space and support services, while accelerators focus on helping startups achieve rapid growth. These programs can provide valuable networking opportunities and access to funding, but they may require a significant equity stake in your business.

Friends and family can provide a source of funding for entrepreneurs who are just starting their business. This funding option is often more flexible than other types of funding and may not require collateral or extensive documentation. However, borrowing from friends and family can strain personal relationships and should be approached with caution. It's important to have a clear agreement in place outlining the terms of the loan, including repayment schedule and interest rates.

Corporate funding refers to financing provided by corporations to startups in exchange for equity. This funding option can provide access to industry expertise, resources, and strategic partnerships. However, corporate investors may have different goals and objectives than the entrepreneur, which could lead to conflicts.

Initial Coin Offerings (ICO) is a method of raising funds for a new cryptocurrency venture. ICOs involve issuing digital tokens or coins that investors can purchase using cryptocurrency or fiat currency. ICOs can provide access to large amounts of capital quickly, but they are unregulated and high-risk.

Securing funding is an essential part of the startup journey, and there are various types of funding available for entrepreneurs to choose from. It's important to understand the advantages and disadvantages of each funding option and choose the one that aligns with your business's goals and objectives. Remember to approach funding with caution and have a clear plan in place for repaying the investment to avoid future conflicts. With the right funding and strategy in place, you can turn your startup idea into a successful and thriving business.

FAQs

What is the best type of funding for a startup? There is no one-size-fits-all answer to this question. The best type of funding for a startup depends on various factors, including the stage of the business, the amount of funding required, the goals of the entrepreneur, and the investor's expectations.

How do I prepare for a funding round? Preparing for a funding round involves developing a solid business plan, identifying potential investors, and creating a pitch deck that outlines the business's growth potential and financial projections.

What are the common mistakes entrepreneurs make when seeking funding? Common mistakes entrepreneurs make when seeking funding include overvaluing their business, failing to research investors' backgrounds and investment criteria, and not being prepared to answer tough questions about the business.

At Professional Saathi, we offer a range of business consultancy services that help businesses improve their performance, achieve growth, and overcome challenges.

Copyright 2026 © Created By KTPG PROFESSIONAL SAATHI CORPORATE CONSULTANT PRIVATE LIMITED, All Rights Reserved.

Leave Your Comment