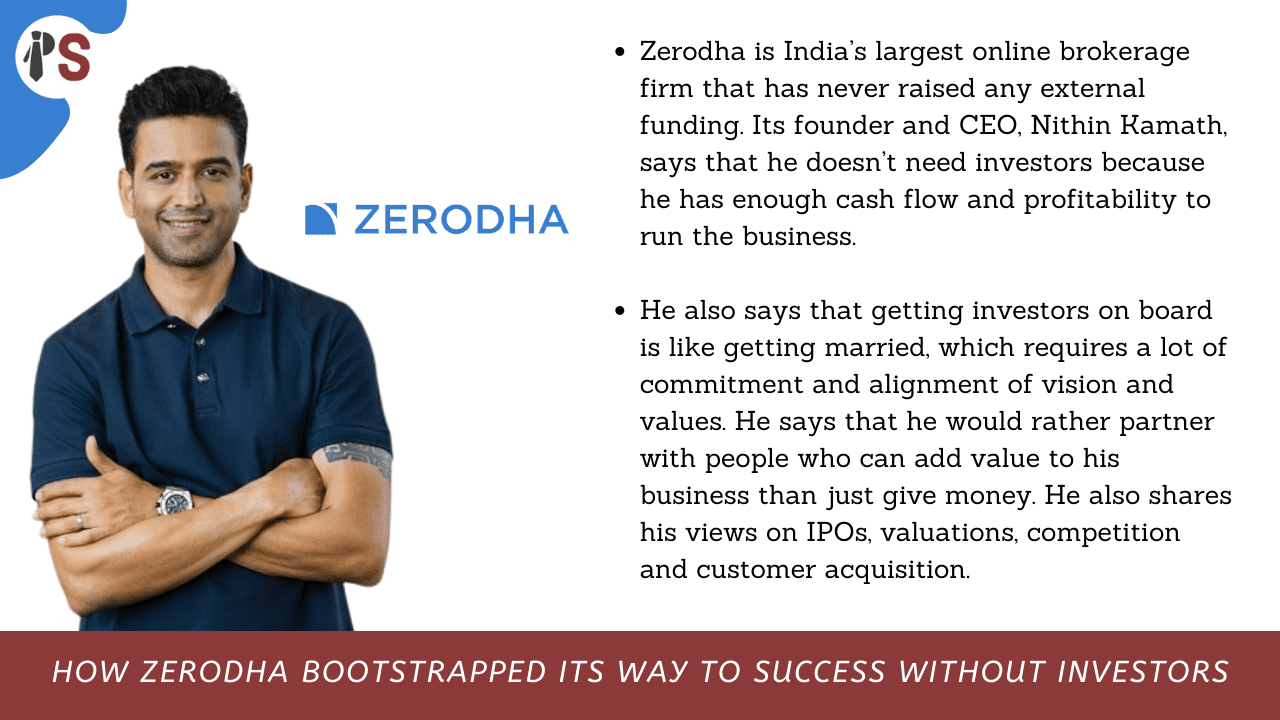

Nithin Kamath, the founder and chief investor of Zerodha, claimed that high valuations are harmful and that they primarily result from overestimating the size of the potential. He continued by saying that getting investors on the board is similar to getting married and that having unrealistic expectations when trying to recruit investors might result in conflicts and disappointments.

In a LinkedIn article, Kamath stated, "We celebrate valuations, yet the more founders I interact with, the more I'm certain high valuations are harmful. Overestimating the extent of the opportunity is the main cause of higher valuations. Outliers do exist, but they are the exception rather than the rule.

Getting investors on board is similar to getting married, he continued, in that having unrealistic expectations beforehand can lead to disappointments and disputes that don't usually work out well.

The CEO of Zerodha added that it is disappointing to see companies that would have succeeded otherwise struggle because investors gave them money at inflated prices, leading business owners to increase spending, hire more people, and place irrational bets. Kamath emphasised further that founders lose interest if estimates about their business's total addressable market (TAM) don't come true and its growth isn't quick enough to support value.

"Greater valuations force you to spend more, recruit more people, and place more bets," he said. If the total addressable market (TAM) estimations are incorrect, founders lose interest since it is unable to develop quickly enough to support the valuations.

Additionally, Kamath claimed that irrational TAM assumptions are a bigger issue in India because the top 2 crore Indians, or roughly 1.5% of the population, are the only ones who have access to income opportunities as opposed to lending, which is competitive. He concluded by saying that lower valuations and raising only the necessary amount will benefit entrepreneurs in concentrating and advancing the development of a successful and long-lasting business.

Unreasonable TAM assumptions are a bigger issue in India because there are only 2 crore People (or around 1.5% of the population) who can earn money through sources other than lending. A lot of people are lending. So certainly, I think lower valuations and raising only what is necessary counterintuitively can help founders focus and improve the chances of creating a successful, long-lasting organisation," Kamath concluded.

Related Searches

At Professional Saathi, we offer a range of business consultancy services that help businesses improve their performance, achieve growth, and overcome challenges.

Copyright 2026 © Created By KTPG PROFESSIONAL SAATHI CORPORATE CONSULTANT PRIVATE LIMITED, All Rights Reserved.

Leave Your Comment