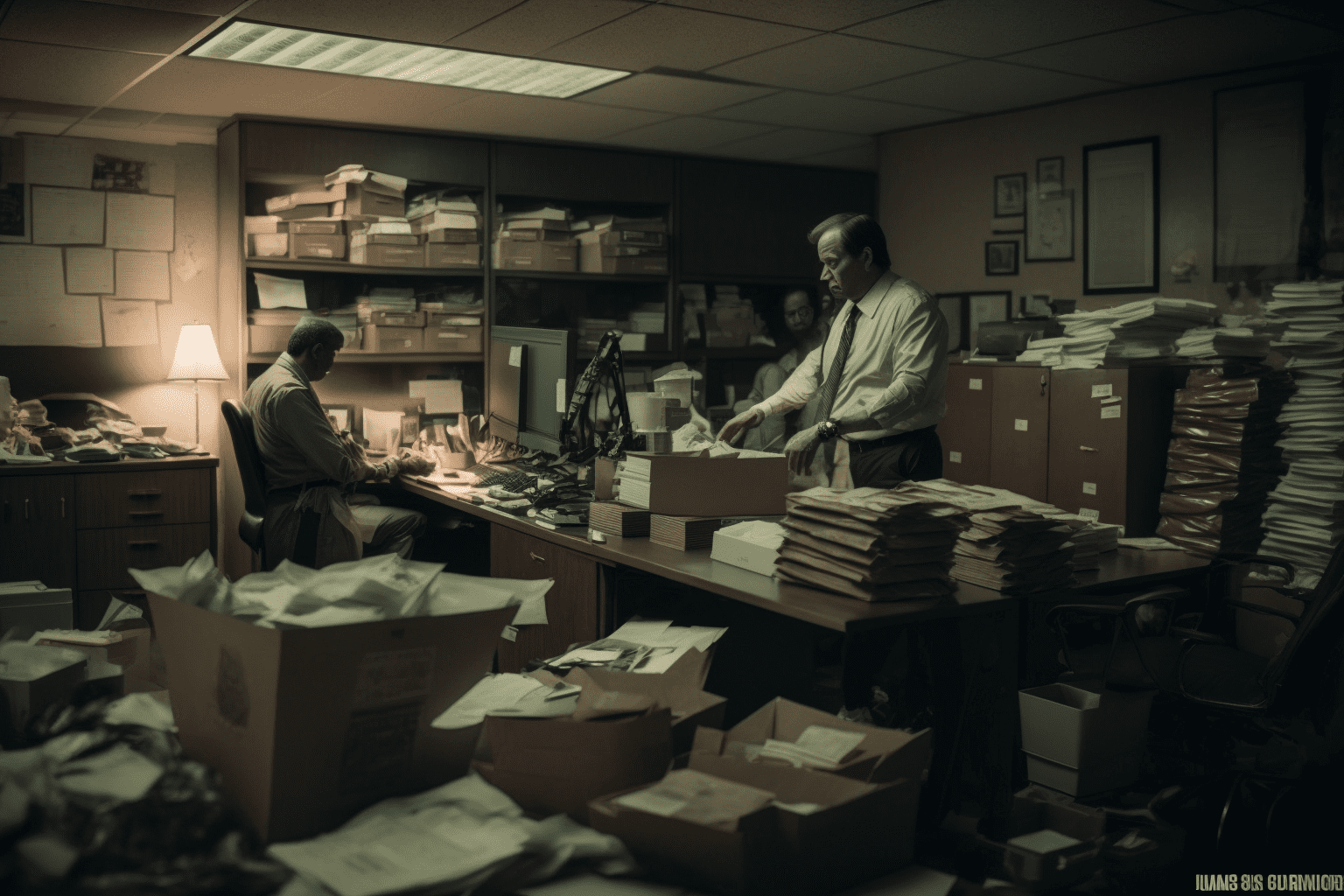

Fraud is a serious problem for businesses, and it can be very bad for their finances and reputations. There are many kinds of business fraud, such as stealing assets, lying on financial statements, and bribery. Fraud can be a problem for businesses, but they can take steps to prevent it and find it. In this article, we'll talk about the different types of business fraud and the controls that can be put in place to stop and find them.

Asset Misappropriation

The most common type of business fraud is the theft of assets, which makes up about 80% of all cases. In this type of fraud, employees steal things like cash, inventory, and equipment that belong to the company. Internal controls, such as segregation of duties and regular audits, are the best way to stop assets from being stolen. Companies can also do background checks on their employees to find those who have stolen or committed fraud in the past.

Financial Statement Fraud

Financial statement fraud is when investors and creditors are tricked by false financial statements. Most of the time, senior management or executives are the ones who commit this kind of fraud. Companies should make sure that their financial reporting is accurate and clear to avoid financial statement fraud. They can also set up internal controls, such as making sure financial documents have more than one signature and doing regular audits.

Corruption

Corruption is when people take money or do other illegal things to get an unfair advantage in business. Companies should have a code of conduct that tells employees how to act ethically and tells them how to handle conflicts of interest. They can also set up internal controls, like requiring approval for spending on gifts and entertainment and checking the backgrounds of vendors.

Preventive Controls

Controls for preventing fraud are things that companies can do to stop it from happening. Some of these are putting in place internal controls, doing background checks on employees and vendors, and teaching employees about ethics. Internal controls can help find fraud by separating jobs, doing regular audits, and making employees take vacations.

Detection Controls

Detection controls are ways for a company to find out about fraud that has already happened. Some of these are data analytics, fraud risk assessments, and hotlines for people who want to report fraud. Data analytics can be used to find inconsistencies in financial transactions, and fraud risk assessments can show where in a business fraud is most likely to happen. Whistleblower hotlines let workers report suspicious behaviour without worrying that they will be punished.

In the end, business fraud is a serious problem that can lead to terrible results. But businesses can reduce the chances of fraud and protect themselves from financial and reputational damage by putting in place controls to prevent and find fraud.

#businessfraud #preventioncontrols #detectioncontrols #assetmisappropriation #financialstatementfraud #corruption #internalcontrols #whistleblowerhotlines

At Professional Saathi, we offer a range of business consultancy services that help businesses improve their performance, achieve growth, and overcome challenges.

Copyright 2026 © Created By KTPG PROFESSIONAL SAATHI CORPORATE CONSULTANT PRIVATE LIMITED, All Rights Reserved.

Leave Your Comment